Why The Real Estate Capital Stack Matters When Things Go South

By Jalen West

Where in the capital stack does my money sit? Your answer determines not only your return profile in good times, but also your level of protection in bad times.

Invest Clearly's Education content features in-depth, reference-quality content created specifically for passive real estate investors.

Each article is designed to educate LPs on concepts, strategies, and terminology across the real estate syndication and private equity investment lifecycle. All content is written by the Invest Clearly team and serves as a reliable resource for both new and experienced investors looking to deepen their understanding of passive investing.

By Jalen West

Where in the capital stack does my money sit? Your answer determines not only your return profile in good times, but also your level of protection in bad times.

By Invest Clearly

Every real estate deal needs funding, which is why real estate syndication and private equity investments have become so widespread. However, where that money comes from and in what order it gets repaid isn't random. It's structured carefully, layer by layer, in what's known as the capital stack.

By Invest Clearly

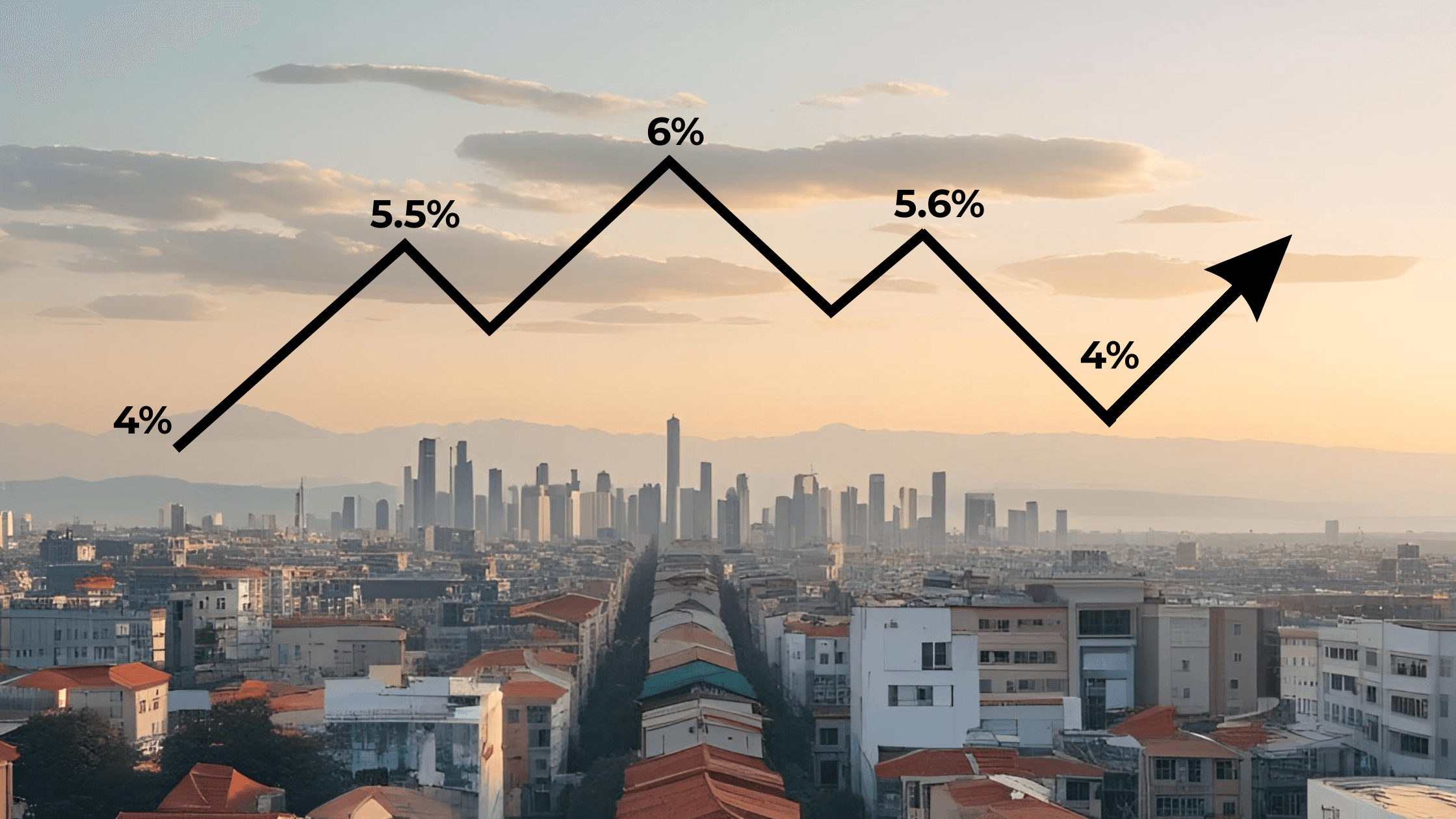

Learn about cap rates, how they are used in commercial real estate, and how investors should consider them when evaluating passive real estate investments.

By Invest Clearly

A real estate syndication is a common investment structure that pools capital from multiple investors to acquire and manage larger commercial real estate assets.