From Interest to Action: A Step-by-Step Guide for First-Time Syndication Investors

Never miss an Invest Clearly Insights article

Subscribe to our newsletter today

Last week, a conversation highlighted a common challenge for new investors. An acquaintance couldn’t pull the trigger on their first syndication deal. They understood the appeal of steady cash flow and long-term appreciation, but paralysis took over and no opportunity felt right. They finally asked, “Knowing what you know now, how would you start if you were beginning today?”

Answering took some real reflection.

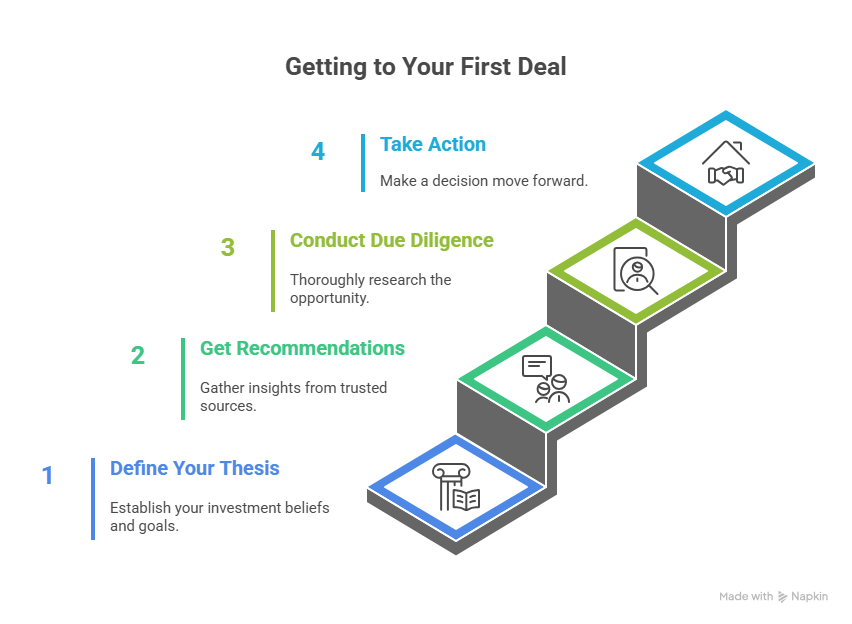

From that came four essential steps—the most direct path from curious observer to committed investor. The steps themselves aren’t complicated, but the order matters. Each one builds the foundation for the next, creating a clear structure that turns general interest into confident decisions. More importantly, this sequence helps break through the decision paralysis many high-earning professionals face when evaluating syndication opportunities for the first time.

Step 1: Establish Your Investment Thesis

Gaining real clarity on your investment thesis and strategy is one of the most important—and most challenging—steps in becoming an investor. Everyone wants the same things: strong cash flow, solid appreciation, low risk, and good tax benefits. That perfect deal does not exist. Every opportunity involves tradeoffs, and your thesis clarifies which tradeoffs make sense for you.

Your investment thesis forces you to define your actual goals. Ask yourself:

- Are you aiming to replace earned income with cash flow or build long-term net worth?

- Do you need to offset high W-2 income with tax advantages?

- How much downside can you accept?

- How long can you tie up capital without needing liquidity?

Your answers determine which opportunities deserve your attention and which should be immediately dismissed. Without this clarity, you waste time analyzing deals that might be excellent for someone else but completely wrong for your situation.

A clear thesis helps you identify deals that fit your criteria and quickly rule out those that don’t. This filtering becomes even more important as your network grows and deal flow increases.

The difference in approach becomes obvious when comparing investor profiles. Someone who needs immediate cash flow evaluates opportunities very differently from someone focused on long-term appreciation. A cash-flow-driven investor may choose stabilized mobile home communities in secondary markets. An appreciation-focused investor may target ground-up development in high-growth metros with little current income but strong upside. Both approaches can work; neither fits every investor.

Step 2: Leverage Your Network for Recommendations

Conversations with people already participating in syndication deals offer tremendous value.

Explore what drew them toward their particular investments. Inquire about current performance. Ask whether they can suggest sponsors whose offerings match your defined investment thesis.

The syndication community is small and connected. Investors with a few years of experience often know several reputable sponsors personally or through trusted peers. Strong sponsors build good reputations through consistent performance and honest communication. Weak sponsors develop reputations as well, though those insights usually circulate quietly.

For new investors, this network is a major advantage. Getting recommendations from people you trust or through reviews on Invest Clearly gives you a far better starting point than trying to evaluate every deal that hits your inbox. Your network becomes an initial filter, pointing you toward sponsors with real track records and away from those who don’t deserve your time.

When you speak with other investors, go beyond surface-level feedback. Ask questions such as:

- How transparent is the sponsor when challenges arise?

- Have any unexpected issues or surprises come up during the hold period?

- Would they invest more money with the same sponsor?

- Have they referred close friends or family?

The answers reveal information you will never find in marketing materials.

If you are reading this, you already have at least one connection in the syndication world through me. I am not a syndicator, but I maintain relationships across the industry and can often point investors toward sponsors whose approach aligns with specific investment philosophies. Engaging with this content before you “need” it gives you a practical edge—you build knowledge and relationships ahead of time, so you are ready when the right opportunity appears.

Your network also accelerates your education. Conversations with experienced investors expose you to different risk tolerances, due diligence styles, and lessons learned. This collective insight helps you avoid common mistakes and identify factors you might otherwise overlook.

Still, recommendations are only a starting point. A sponsor who performs well for someone else may not align with your goals or your comfort with risk. Personal fit matters. You will work with this sponsor for years, rely on their communication, and trust them with meaningful capital. The relationship must work for you—even if it has worked well for others.

Step 3: Conduct Thorough Due Diligence

Receiving a recommendation falls short of justifying an investment on its own. Dedicating time to independent sponsor due diligence remains essential. Due diligence is your primary defense against not only inexperienced or underperforming operators, but also against outright fraud. I know investors who lost money in two separate Ponzi schemes, and I personally avoided one only because due diligence exposed warning signs. These risks are real, and they have wiped out entire investments.

Analyze Track Record

A systematic, thorough approach serves you best. Begin by evaluating the sponsor’s track record:

- How many deals have they completed?

- What asset types do they focus on?

- How have actual results compared with their original projections?

Some deviation from underwriting is normal. No sponsor consistently hits projections on every deal. But repeated underperformance or overly optimistic assumptions should prompt deeper scrutiny.

Review the Deal

Next, review the sponsor’s role in the deal structure. Look at their financial stability and liquidity. They should have the capacity to handle unexpected costs without jeopardizing the project. Also assess how much of their own capital they are investing beyond fees.

Then examine the asset and the market by asking:

- Does the business plan align with actual market conditions?

- Are renovation budgets realistic?

- Do comparable properties support the projected rents?

- What do population and employment trends show?

- What natural disasters could affect the property

- Are insurance coverage and reserves adequate?

Consider Professional Due Diligence

At this point, many investors hire professional due diligence firms and legal counsel for document review. This adds cost, which may feel significant on your first investment, but it acts as inexpensive insurance relative to the total capital at risk. It also accelerates your learning and sharpens your future due diligence process.

Some investors skip professional help, especially early on. That choice is understandable, but it increases your risk. You are relying entirely on your own analysis and the sponsor’s disclosures, without the benefit of experts who might catch issues you miss. This may be an acceptable tradeoff depending on your circumstances, but it should be a conscious decision—not an oversight.

The time and money you invest in due diligence pays off beyond simple risk reduction. The process builds conviction. When you deeply understand what you own and why you own it, you can hold your position through the multi-year timelines that syndication investments require without constant second-guessing.

Step 4: Commit and Take Action

After due diligence, many investors feel tempted to keep comparing alternatives and running more scenarios. This can be useful to a point, but eventually it becomes avoidance. At some stage, you must take action, sign documents, and send the wire.

Most investors find this final step harder than expected. Saving the capital required effort and syndications involve large sums. Wiring money to a sponsor you may have only spoken with a few times can feel uncomfortable. I felt that way on my first investment, and the feeling still shows up today after more than a dozen deals.

This discomfort is normal and reflects the reality of taking a risk. Syndications are illiquid, long-term, and carry the possibility of loss. The goal is not to eliminate the discomfort. The goal is to move forward despite it, after doing the work to understand and reduce the risks.

You will never reach absolute certainty. There will always be more questions to research, more scenarios to run, and more deals to compare. At some point, additional analysis adds little value and only delays your progress toward the real objective, building passive income that reduces reliance on earned wages.

This is where your investment thesis becomes critical. If your goals are clear, the opportunity aligns with those goals, and you have completed thorough due diligence on the sponsor and the deal, you have enough information to make a sound decision. Anything beyond that typically feeds anxiety, not insight.

Taking action creates momentum that benefits you far beyond the first investment. You move from observer to participant. You receive investor updates, watch operations unfold over the hold period, and gain practical experience that improves your judgment on future deals. None of this learning happens until capital is actually deployed.

Taking action does not mean rushing into a poor-fit deal. It means fully completing your process, then making a decision based on the information you assembled, not staying stuck in pursuit of impossible certainty. Without this final step, you do not move any closer to financial independence than when you first learned about syndication investing.

Building Your Path Forward

These four steps create a practical framework that turns interest into real capital deployment.

Remember, the order matters. Evaluating deals before clarifying your thesis leads to confusion and wasted effort. Cutting corners on due diligence exposes you to unnecessary risk. Completing due diligence but never wiring funds keeps you on the sidelines, watching others build the passive income you want without ever participating yourself.

The first full cycle is the hardest. Your initial investment requires building confidence in your process while accepting real financial risk. Each subsequent deal becomes easier as your sponsor relationships strengthen, your diligence process improves, and your firsthand experience grows.

The goal is not a perfect investment. Perfection does not exist. The real goal is finding suitable investments that align with your thesis, come from operators you trust, and move you closer to financial independence through passive income. These opportunities are plentiful, and the framework above gives you a clear path for identifying them and moving forward with confidence.

For more articles on passive investing, you can follow my newsletter. Feel free to reach out to me with any questions.

Written by

Terence’s career has been in tech, with his most recent role being at Amazon. Outside of his day job, he has been investing in Real Estate for over 30 years, primarily in small properties. In 2019, he discovered what he considers an optimal strategy for busy professionals – investing in syndications to provide passive income streams. This strategy has allowed him to break his paycheck dependency without creating another job and retire early. He has created MBC Real Estate Investing, LLC to share his insights and strategies with other passive investors. You can follow him on LinkedIn or through his blog Thoughts on Passive Investing.

Other Articles

Investor Experience Index: 2025 Wrap Up

We’ve analyzed review data from 2025 to uncover surprising trends in private real estate.

The New Approach to Sponsor Due Diligence in Private Real Estate

Start your due diligence with the sponsor and the business plan before focusing on the real estate asset.

Is Private Equity Coming to Your 401(k)?

A new executive order could lead to private markets getting access to 401(k) capital. Learn how a new wave of capital and liquidity demands could affect private real estate.

What 2025 Fundraising Data Reveals About LP Capital Allocation in Private Real Estate

Private real estate fundraising saw a rebound in 2025, marking the first year-over-year increase in annual capital raised since 2021. According the PERE Fundraising Report Full Year 2025, total fundraising reached $222 billion, up 29 percent from the $172.4 billion raised in 2024.

How Moving Up the Capital Stack Can Reduce Your Investment Risk

At the height of the worst financial crisis since the Great Depression, Buffett invested $5 billion in Goldman Sachs as preferred equity. Here's why....

Why Most Investors Waste Time on the Wrong Opportunities

Many investors jump from one investment type to the next: cryptocurrency one month, precious metals the next. Successful investors operate from a documented investment thesis.