Investor Experience Index: 2025 Wrap Up

Never miss an Invest Clearly Insights article

Subscribe to our newsletter today

Investor Experience Index: 2025 Wrap Up

The Investor Experience Index provides a quarterly snapshot of how limited partners (LPs) rate their experiences with general partners (GPs). The data for this report is drawn exclusively from investor reviews published on Invest Clearly in 2025.

When reviews are submitted to Invest Clearly, LPs provide an overall score but are also asked to rate sponsors across four specific data points:

- Pre-investment communication

- Post-investment communication

- Strength of leadership

- Alignment of expectations

These inputs, along with overall ratings, provide a detailed view of investor sentiment and sponsor performance. By analyzing how category scores correlate with overall ratings, we can identify which sponsor behaviors most strongly influence satisfaction, trust, and the likelihood of reinvestment.

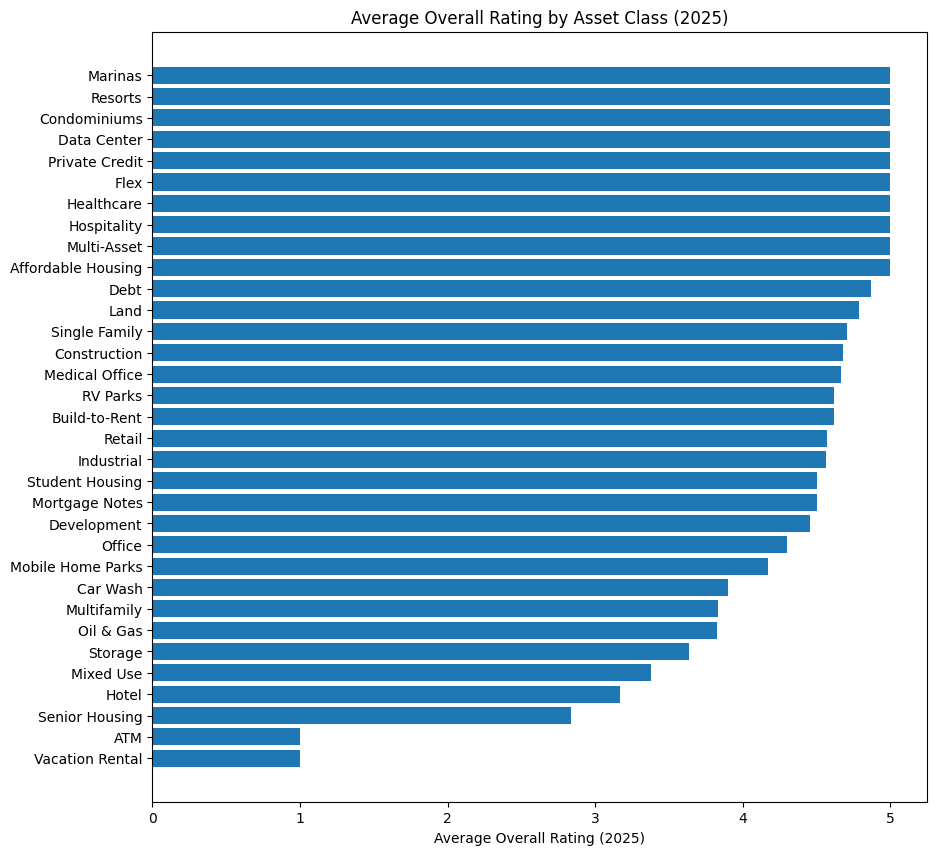

Sponsors with the Best Reviews by Asset in 2025

When grouping sponsors by the asset classes calculating the average overall rating, several categories appear at the top with an average score of 5.0, including:

- Affordable Housing

- Resorts

- Retail

- Build-to-Rent

- Condominiums

These results do not imply that asset class determines investor satisfaction. Instead, they suggest that certain segments may lend themselves to tighter communication loops, more concentrated investor bases, or simpler portfolio narratives. Asset class acts as context rather than cause.

LP takeaway: Asset class alone does not determine investor experience, but some categories show more consistently strong outcomes in 2025 reviews.

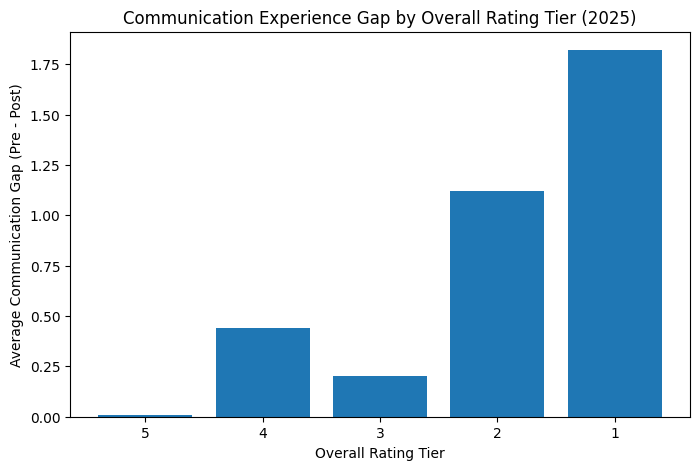

The Communication Gap

The Communication Experience Gap measures how consistently sponsors communicate with investors before and after an investment is made. It is calculated as:

Communication Gap = Pre-Investment Communication Rating−Post-Investment Communication

A larger gap indicates that communication is rated much stronger during the fundraising phase

This analysis shows a clear relationship between overall investor satisfaction and communication consistency. Sponsors with five-star ratings exhibit a limited gap, meaning sponsors maintain strong communication both before and after commitment. By contrast, lower-rated sponsors show a sharply widening gap, driven by a decline in post-investment communication.

Using Sponsor Ratings as a Proxy for Investor Relations Durability

Even without review category-level detail, the overall rating appears to function as a summary measure of whether the sponsor delivers a consistent experience throughout the investment lifecycle. Sponsors with strong overall ratings are more likely to provide stable investor communication over time.

As Sponsor Scale Increases, Investor Experience Declines

Sponsor scale introduces structural complexity that can influence investor experience. Grouping sponsors by assets under management provides a useful lens for understanding how scale interacts with communication, leadership, and expectation alignment.

AUM Range | Pre-Investment Communication | Post-Investment Communication | Leadership Team Strength | Alignment of Expectations | Overall Rating |

Up to $50M | 4.97 | 4.99 | 4.95 | 4.97 | 4.99 |

$50M – $100M | 4.82 | 4.64 | 4.64 | 4.64 | 4.64 |

$100M – $250M | 4.94 | 4.79 | 4.79 | 4.77 | 4.78 |

$250M – $500M | 4.50 | 4.31 | 4.31 | 4.27 | 4.27 |

$500M – $1B | 4.00 | 3.46 | 3.46 | 3.29 | 3.46 |

$1B+ | 4.21 | 2.59 | 2.59 | 2.41 | 2.38 |

Unknown | 4.42 | 3.34 | 3.34 | 3.08 | 3.24 |

Across the 2025 reviews, smaller and mid-sized sponsors under $250 million in AUM show the strongest average ratings across every category. Ratings decline progressively in higher AUM tiers, with the lowest averages appearing among sponsors managing more than $1 billion.

This trend suggests that scale places pressure on investor engagement. This pattern could be be explained by a lack of:

- Customer service and engagement from the IR team

- Established alignment during the investment process

- Investor outreach to request reviews

These structures support efficiency but can reduce personalization and responsiveness from an LP perspective.

LP takeaway: Larger AUM does not signal a better investor experience and may introduce communication and alignment risk.

Leadership Strength Declines with Sponsor Scale

Leadership strength represents how LPs perceive the visibility, accessibility, and accountability of a sponsor’s leadership team. It reflects day-to-day experience rather than organizational charts.

The 2025 review data shows leadership ratings trending downward as sponsor AUM increases. Smaller firms receive the highest leadership scores. Larger sponsors receive meaningfully lower ratings on average.

One plausible explanation is that as firms scale, leadership becomes more operationally removed from day-to-day investor engagement. LPs may have fewer direct touchpoints with senior decision-makers, which can create a perceived gap between the leadership team and the investor experience. In this context, leadership strength may reflect not only execution capability, but also accessibility, accountability, and visibility.

Alignment of Expectations Shows a Similar Pattern

Alignment of expectations measures how closely the post-investment experience matches what was communicated during the investment process.

Expectation alignment declines alongside sponsor scale in the 2025 data. The pattern closely mirrors trends observed in communication and leadership ratings.

This pattern likely reflects the structural complexity that comes with scale. Larger sponsors often manage broader portfolios, more layered internal teams, and more standardized investor communications. While these systems can improve efficiency, they may also reduce personalization and clarity around deal-level expectations. As a result, LPs may experience more disconnect between what was communicated during the investment process and what unfolds post-close. Expectation alignment appears to be one of the most scale-sensitive dimensions of the investor experience.

Sponsor Tenure vs Average Ratings (2025)

Many LPs use sponsor tenure as a credibility cue during due diligence. The 2025 review data allows a direct test of how sponsor age tracks with experience ratings across communication, leadership, expectation alignment, and overall satisfaction.

Sponsor Tenure Tier | Pre-Investment Communication | Post-Investment Communication | Leadership Strength | Alignment of Expectations | Overall Rating |

0–5 yrs | 4.85 | 4.78 | 4.76 | 4.78 | 4.78 |

6–10 yrs | 4.44 | 3.90 | 3.68 | 3.56 | 3.67 |

11–20 yrs | 4.74 | 4.24 | 4.20 | 4.00 | 4.05 |

20+ yrs | 4.38 | 3.00 | 2.46 | 2.23 | 2.38 |

Not disclosed | 4.27 | 3.67 | 3.67 | 3.53 | 3.60 |

The 2025 review data suggests that “years in the business” alone is not a reliable predictor of investor satisfaction. Emerging sponsors in the earliest tenure tier (0–5 years) show the strongest average ratings across communication, leadership, expectation alignment, and overall experience. Ratings remain relatively strong among sponsors with 11–20 years in business, but decline notably in the 20+ year tier, particularly in post-investment communication, leadership strength, and alignment of expectations.

One plausible interpretation is that as firms mature and scale operationally, investor engagement can become less direct and less consistent. More established sponsors may rely on standardized systems and larger internal teams, which can reduce leadership visibility and create greater distance between investors and decision-makers. The tenure trends reinforce that LP experience is shaped less by how long a sponsor has been operating and more by how effectively the sponsor maintains communication, accountability, and alignment throughout the investment lifecycle.

What This Data Cannot Fully Answer

The Investor Experience Index reflects voluntary review activity, which introduces natural limitations. Review volume varies by sponsor size, investor base, and outreach practices. Some sponsors may encourage reviews more actively than others.

The data also raises open questions. Scale may affect experience through structural distance rather than intent. Smaller sponsors may maintain closer relationships simply due to narrower focus. Leadership visibility may matter as much as leadership capability.

Despite these considerations, the patterns observed across communication, leadership, alignment, and overall ratings remain consistent. The data provides directional insight that supports informed interpretation rather than definitive judgment.

Using Investor Experience as a Diligence Lens

The 2025 Investor Experience Index points to a clear conclusion; investor satisfaction does not align with pre-investment communication. In other words, the sales process is not indicative of the investment outcome. As a result, investors need to seek out more context before committing capital, starting by reading investor reviews on Invest Clearly.

As review volume grows over time, the Index will continue to sharpen its ability to surface meaningful trends. Its purpose remains straightforward. Investor experience is measurable, and behavior after commitment carries lasting weight.

Written by

Invest Clearly empowers you to make informed decisions by hosting unbiased reviews of passive investment sponsors from verified experienced investors.

Other Articles

The New Approach to Sponsor Due Diligence in Private Real Estate

Start your due diligence with the sponsor and the business plan before focusing on the real estate asset.

Is Private Equity Coming to Your 401(k)?

A new executive order could lead to private markets getting access to 401(k) capital. Learn how a new wave of capital and liquidity demands could affect private real estate.

What 2025 Fundraising Data Reveals About LP Capital Allocation in Private Real Estate

Private real estate fundraising saw a rebound in 2025, marking the first year-over-year increase in annual capital raised since 2021. According the PERE Fundraising Report Full Year 2025, total fundraising reached $222 billion, up 29 percent from the $172.4 billion raised in 2024.

How Moving Up the Capital Stack Can Reduce Your Investment Risk

At the height of the worst financial crisis since the Great Depression, Buffett invested $5 billion in Goldman Sachs as preferred equity. Here's why....

Why Most Investors Waste Time on the Wrong Opportunities

Many investors jump from one investment type to the next: cryptocurrency one month, precious metals the next. Successful investors operate from a documented investment thesis.

What Is the Difference Between Core, Core-Plus, Value-Add, and Opportunistic Real Estate?

Learn how each risk profile summarizes an investment's expected returns and risk to make it easier to identify opportunities that meet your investment criteria.