What 2025 Fundraising Data Reveals About LP Capital Allocation in Private Real Estate

Never miss an Invest Clearly Insights article

Subscribe to our newsletter today

What 2025 Fundraising Data Reveals About LP Capital Allocation in Private Real Estate

Private real estate fundraising saw a rebound in 2025, marking the first year-over-year increase in annual capital raised since 2021. According the PERE Fundraising Report Full Year 2025, total fundraising reached $222 billion, up 29 percent from the $172.4 billion raised in 2024.

While the headline suggests renewed confidence in the asset class, that’s not the only insight for LPs. Capital did not return evenly across strategies, sectors, or sponsors. It concentrated quickly and rotated decisively.

Capital Concentration Defined the Recovery

A significant share of 2025’s fundraising resurgence was driven by a small number of dominant institutional sponsors. Blackstone and Brookfield alone accounted for approximately 16 percent of total capital raised during the year.

Both firms closed three of the ten largest real estate funds of 2025, including Brookfield Strategic Real Estate Partners V at $16 billion and Blackstone Real Estate Partners Europe VII at $11 billion. Their fundraising momentum was particularly pronounced in the first quarter, where their combined efforts contributed to more than $35 billion raised. That activity helped deliver the strongest first-quarter real estate fundraising total in at least five years, reaching $81.4 billion.

For LPs, this pattern is familiar. In periods of market transition, capital tends to gravitate toward sponsors with scale, established track records, and perceived execution certainty.

Data Centers Took the Lead in 2025 Fundraising

In 2023, were you thinking about data centers and how they fit into your investment strategy? Most weren’t.

The biggest shift in private real estate fundraising last year was that data center–focused strategies grew from just 2 percent to 37 percent of fundraising. In a single year, data centers moved from a marginal allocation to the most sought-after sector-specific strategy in private real estate.

Several large fund closes illustrate the scale of this shift. The $7 billion Blue Owl Digital Infrastructure Fund III and the $3.6 billion Principal Data Center Growth & Income Fund were among the largest data center vehicles raised during the year. Together, these funds represented a substantial portion of total capital committed to the sector and underscored the growing institutional appetite for digital infrastructure assets.

As capital flowed aggressively into data centers, traditional sector allocations declined. Industrial real estate funds saw their share of sector-specific fundraising fall from 26 percent in 2024 to 16 percent in 2025. Residential strategies experienced a similar contraction, dropping from 49 percent to 32 percent over the same period.

What’s Driving Changes in Private Real Estate Fundraising?

The AI race is on. The appeal of data center investments is anchored in long-term demand expectations rather than short-term pricing trends. Growth in cloud computing, AI, and enterprise data storage has created structural demand that many investors view as less sensitive to traditional real estate cycles.

However, the speed of capital inflows is as important as the demand itself. When more than one-third of sector-specific fundraising flows into a single strategy in one year, competition intensifies across acquisition, development, and operating environments.

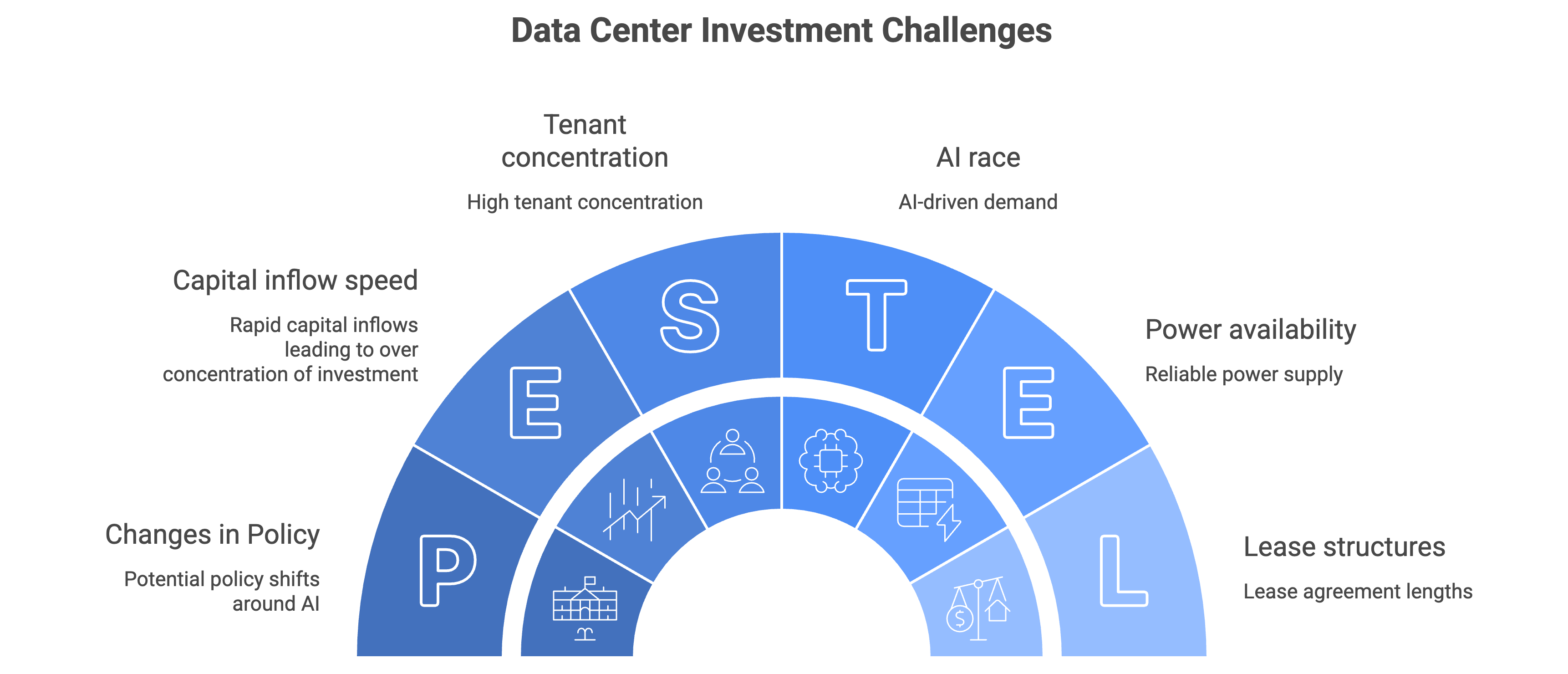

For LPs, this raises important considerations. Increased competition can compress yields, push underwriting assumptions, and elevate execution risk. Investment success will also rely on:

- Power availability

- Construction timelines

- Tenant concentration

- Lease structures

- Continued demand growth

LPs considering these asset classes should be asking:

- How dependent are returns on aggressive rent growth or lease-up assumptions?

- What exposure does the strategy have to new supply risk?

- How resilient are cash flows if lease terms shorten or renewals decline?

- What operational risks arise from specialized infrastructure requirements?

- How exposed is the investment to regulatory, utility, or grid-related approvals outside the sponsor’s control?

- What risks emerge if capital is raised faster than it can be deployed?

What the 2025 Data Signals for LP Due Diligence

The 2025 fundraising rebound reinforces a broader shift in how LPs approach private real estate allocation. Evaluating individual deals in isolation is no longer sufficient when capital is concentrating rapidly around specific sponsors and sectors.

In environments like this, sponsor behavior, operational capability, and execution history play an outsized role in determining outcomes. There’s no question that capital is rapidly returning to commercial real estate. The more relevant question is how effectively that capital will be deployed as competition intensifies and strategies scale.

Cutting Through Fundraising Momentum

Fundraising totals and fund sizes are often interpreted as signals of quality or safety. In reality, they reflect capital momentum at a point in time. Think of multifamily real estate in 2022 compared to 2025 as a good recent example.

Instead of simply following trends, LPs who want to invest with confidence need to understand how sponsors execute after the capital is raised is critical. That includes how they navigate crowded sectors, manage operational risk, and communicate when conditions evolve differently than planned.

Written by

Invest Clearly empowers you to make informed decisions by hosting unbiased reviews of passive investment sponsors from verified experienced investors.

Other Articles

Investor Experience Index: 2025 Wrap Up

We’ve analyzed review data from 2025 to uncover surprising trends in private real estate.

The New Approach to Sponsor Due Diligence in Private Real Estate

Start your due diligence with the sponsor and the business plan before focusing on the real estate asset.

Is Private Equity Coming to Your 401(k)?

A new executive order could lead to private markets getting access to 401(k) capital. Learn how a new wave of capital and liquidity demands could affect private real estate.

How Moving Up the Capital Stack Can Reduce Your Investment Risk

At the height of the worst financial crisis since the Great Depression, Buffett invested $5 billion in Goldman Sachs as preferred equity. Here's why....

Why Most Investors Waste Time on the Wrong Opportunities

Many investors jump from one investment type to the next: cryptocurrency one month, precious metals the next. Successful investors operate from a documented investment thesis.

What Is the Difference Between Core, Core-Plus, Value-Add, and Opportunistic Real Estate?

Learn how each risk profile summarizes an investment's expected returns and risk to make it easier to identify opportunities that meet your investment criteria.