Never miss an Invest Clearly Insights article

Subscribe to our newsletter today

Is Private Equity Coming to Your 401(k)?

How a New Executive Order Could Reshape Retirement and Private Real Estate Investing

Retirement investing is entering a period of policy-driven expansion. A new Executive Order titled Democratizing Access to Alternative Assets for 401(k) Investors instructs the Department of Labor and the Securities and Exchange Commission to open defined-contribution plans to private-market investments. This initiative would allow 401(k) managers to allocate capital to private equity, private credit, real estate, venture capital, hedge funds, and digital assets. The policy draws on a long-running industry objective: broaden the investor base for private markets and unlock a substantial new source of capital.

Private-market firms have been pushing for a moment like this. Many institutional investors have pushed their allocations to the edge. Institutional allocations to private markets are stretched, fundraising has cooled, and managers are looking for their next large, stable capital base. Roughly $13 trillion sits in retirement plans. For context, the USA private equity sector is estimated to be valued at about $6 trillion. Private market firms see retirement plans as their next growth engine.

Private real estate will sit close to the impact point. Fresh 401(k)-linked capital would influence pricing, deal terms, and which sponsors win or lose access to attractive assets. LPs who already invest in private real estate have a strong incentive to understand how this policy move could tilt the playing field in the years ahead.

Why Private Markets Are Suddenly Eyeing Retirement Dollars

Private markets have grown enormously over the past 20 years, and institutional capital has followed suit. But today:

- Many pension funds and endowments are at or near their allocation limits.

- Fundraising cycles have slowed.

- Exit activity is constrained, especially for 2020–2022 vintages.

As Duke law professor Elisabeth De Fontenay notes, the industry is seeking the next major pool of capital and retirement accounts hold roughly $13 trillion in assets. The money is predictable, tends to stay, and rarely demands liquidity at the wrong time.

Why Industry Supporters Are Calling This “The Next Great Equalizer”

While private market access to 401(k) capital might sound risky, not everyone is sounding alarms. They see a retirement system that has remained anchored to public markets even as private markets delivered decades of strong results for institutions

Historically, PE funds have often outperformed public markets. The value firms have created through operational improvements is well documented, and they have returned enormous profits. But most Americans have been unable to access them, which has arguably created a limitation on building wealth.

Supporters also argue that:

- Greater access expands investor choice.

- Retirement accounts with alternative assets will potentially have higher returns.

- Diversification across public and private markets may improve risk-adjusted returns.

- Product innovation can make private‐market exposure more accessible and transparent.

From this perspective, private investments represent an opportunity for retirement growth, while being a private market opportunity set.

.png)

Why Critics Are Alarmed

Skeptics like De Fontenay see a very different picture. They follow the same data but highlight the risks that come with pulling private assets into a retirement system built for liquidity, transparency, and low-cost diversification.

Critics raise several concerns, such as:

- High fees that eat into returns to the point that they are on par with public markets.

- Retail investors likely won’t have access to high-returning top-tier funds, which are typically reserved for large-capacity institutional investors.

- Illiquidity could negatively impact those actively drawing on their retirement accounts.

- Unlike index funds, private investments carry greater risk, including total loss of capital. Many consider this risk a poor match for retirement accounts.

These concerns do not reject private markets outright. They point to a product and market mismatch. Retirement accounts function best when costs are low, pricing is transparent, and liquidity when needed.

A Massive Capital Wave Could Shift the Competition Landscape

If even 5–10% of 401(k) assets move into alternatives, private markets could see hundreds of billions in new capital. Few areas would feel the ripple effects faster than private real estate. The sector already absorbs a meaningful share of institutional alternatives allocations, and pricing will respond to new capital.

For private real estate investors, a new flow of capital could:

- Increase competition for high-quality assets, compressing returns.

- Increase investment minimums as firms scale.

- Normalize “institutional pricing” across formerly mid-market deals.

- Cause priorities to shift from delivering returns to AUM.

New capital from retirement could impact incentives that shape investment decisions. Sponsors that benefit from capital allocations may be pressured to deploy, incentivizing them to gather assets rather than optimize returns.

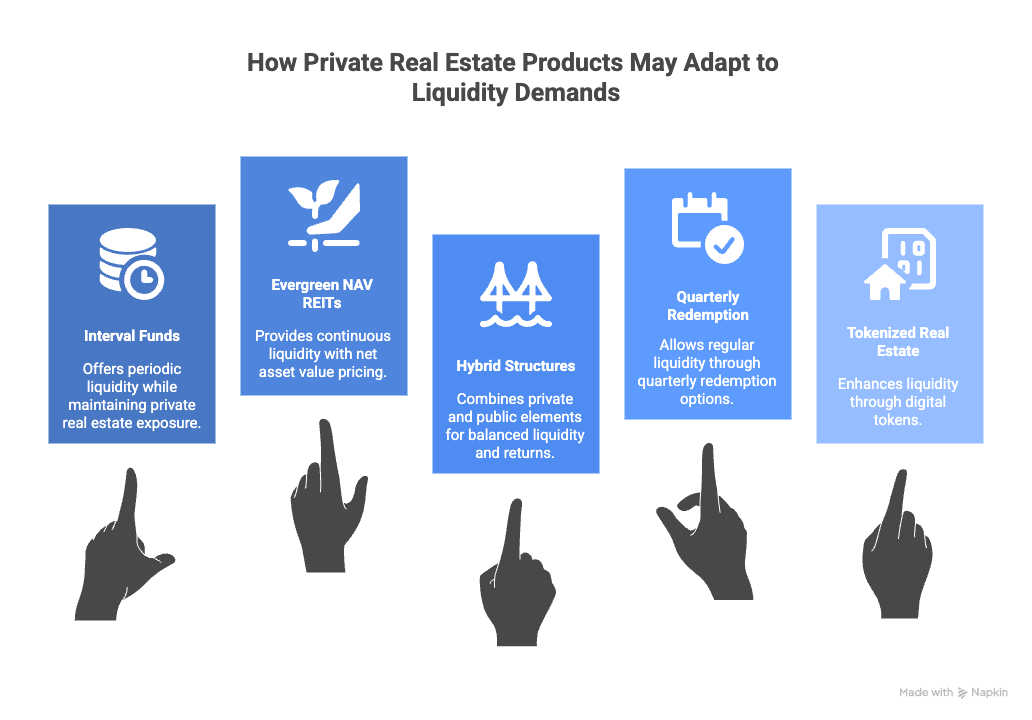

Liquidity Demands Could Change the Nature of Private Real Estate Products

Unlike institutional capital, retirement accounts require liquidity for periodic withdrawals. Private real estate tends to have long hold periods and many have infrequent distributions.

Because 401(k) capital requires some liquidity, firms may develop:

- Interval funds

- Evergreen NAV REITs

- Hybrid private/public structures

- Quarterly redemption mechanisms

- Tokenized real estate options

These structures could pull deal flow away from the traditional closed-end real estate funds most LPs have become accustomed to.

Real Estate Deals Could Be Pulled Into Broader Private Equity Strategies

Big PE firms already raise real estate secondaries, real estate credit, and "opportunistic real estate" vehicles. With 401(k) capital, they may:

- Acquire more operating platforms

- Outbid smaller sponsors on value-add acquisitions

- Buy entire portfolios rather than single properties

Continued scaling of larger firms could make it harder for smaller or niche sponsors to compete on acquisitions. Smaller sponsors may still find opportunities, but they will compete in a market shaped by managers who prioritize deploying capital at volume (even more so than they do today).

Where This Leaves Today’s Private Real Estate Investor

There’s no question that this Executive Order opens a large new channel for private-market capital, and private real estate will sit close to the impact. Whether it’s good or disastrous (for retirement accounts or private markets)-–we will leave for you to decide.

For LPs like you, the best path forward is to stay aware, stay curious, and pay attention to how firms evolve their strategies as new capital enters the space. Watch how managers talk about growth. Keep an eye on fees and how incentives shift. Ask your sponsor if they are planning to accept retirement capital. And track how product structures evolve to accommodate the liquidity needs of retirement plans.

Invest Clearly will continue following the regulatory updates and industry response to keep you informed.

Written by

Invest Clearly empowers you to make informed decisions by hosting unbiased reviews of passive investment sponsors from verified experienced investors.

Other Articles

Investor Experience Index: 2025 Wrap Up

We’ve analyzed review data from 2025 to uncover surprising trends in private real estate.

The New Approach to Sponsor Due Diligence in Private Real Estate

Start your due diligence with the sponsor and the business plan before focusing on the real estate asset.

What 2025 Fundraising Data Reveals About LP Capital Allocation in Private Real Estate

Private real estate fundraising saw a rebound in 2025, marking the first year-over-year increase in annual capital raised since 2021. According the PERE Fundraising Report Full Year 2025, total fundraising reached $222 billion, up 29 percent from the $172.4 billion raised in 2024.

How Moving Up the Capital Stack Can Reduce Your Investment Risk

At the height of the worst financial crisis since the Great Depression, Buffett invested $5 billion in Goldman Sachs as preferred equity. Here's why....

Why Most Investors Waste Time on the Wrong Opportunities

Many investors jump from one investment type to the next: cryptocurrency one month, precious metals the next. Successful investors operate from a documented investment thesis.

What Is the Difference Between Core, Core-Plus, Value-Add, and Opportunistic Real Estate?

Learn how each risk profile summarizes an investment's expected returns and risk to make it easier to identify opportunities that meet your investment criteria.