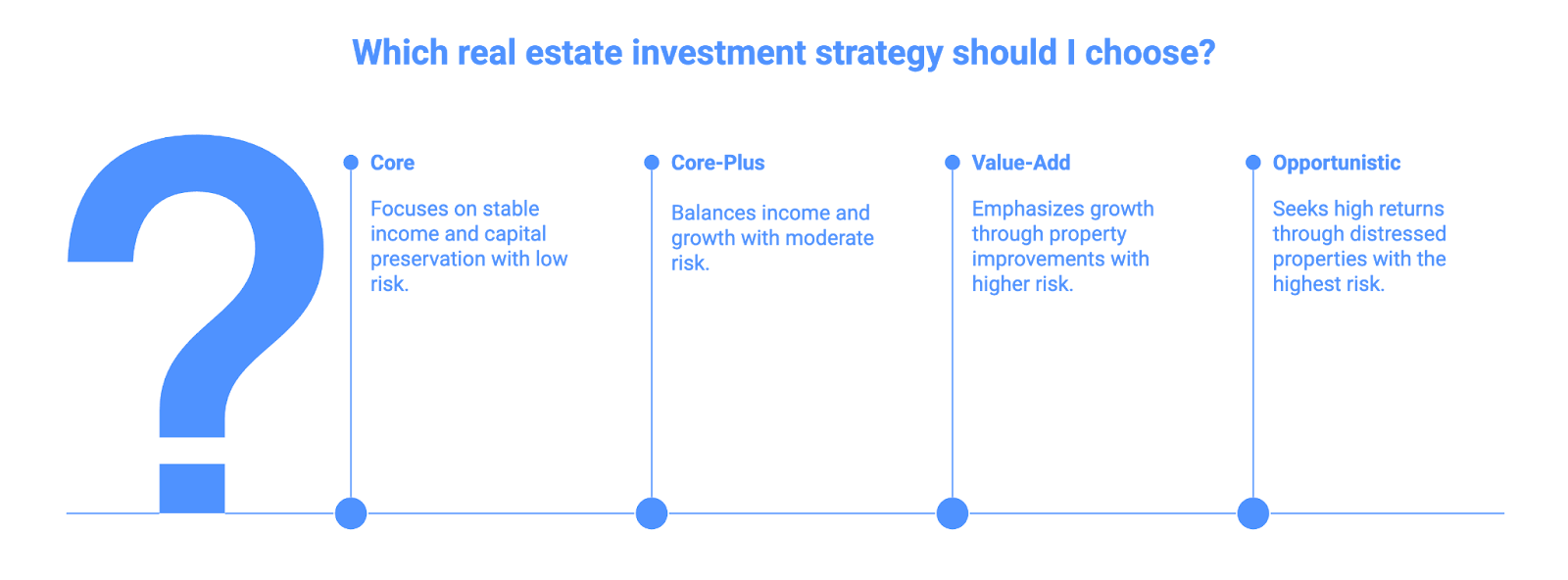

What Is the Difference Between Core, Core-Plus, Value-Add, and Opportunistic Real Estate?

Never miss an Invest Clearly Insights article

Subscribe to our newsletter today

What Is the Difference Between Core, Core-Plus, Value-Add, and Opportunistic Real Estate?

When you start evaluating real estate syndications or other private real estate investments, you’ll come across terms that are meant to quickly convey risk and returns:

- Core

- Core-Plus

- Value-Add

- Opportunistic

These terms have meaning to institutional players, but they might not have meaning to you–yet. Institutional investors use them to describe where a given investment falls in terms of risk and return, but they can also help limited partners evaluate how a deal generates returns, what risks drive outcomes, and how the investment fits within a broader portfolio.

This article explains each strategy in detail, outlines the private real estate risk factors that shape outcomes, and provides a framework for comparing opportunities across the spectrum. While these terms are helpful, it’s important to remember that each category is a generalization and firms may use their definitions broadly.

Why Risk Classifications Matter in Private Real Estate

Returns in real estate investing depends on three primary drivers: income generation, value growth, and capital preservation. Every investment balances these drivers differently. Risk classifications describe how that balance shifts as uncertainty increases or decreases. In other words, they indicate what kind of return an investor should expect for a given amount of risk

Institutional investors use these classifications to:

- Align investments with portfolio objectives

- Set realistic return expectations

- Evaluate whether projected returns match underlying risks

- Compare deals across markets and sponsors

Risk classifications do not describe asset quality alone. They reflect how cash flows behave, how much leverage supports the investment, and how sensitive returns are to market and execution variables. These distinctions become especially important in real estate syndications, where LPs rely on sponsors to execute complex business plans over multi-year hold periods.

The Real Estate Risk Return Spectrum

The real estate risk return spectrum organizes investment strategies from lower-risk, lower-return profiles to higher-risk, higher-return profiles. Movement along the spectrum reflects changes in predictability, operational intensity, and reliance on future outcomes.

At one end of the spectrum sit stabilized assets with durable income streams and limited operational change. At the other end sit investments that depend on development, repositioning, or market dislocation to achieve target returns.

Core, core-plus, value-add, and opportunistic strategies occupy defined positions along this spectrum. As risk increases:

- Income predictability declines

- Leverage often increases

- Cash flow shifts later in the hold period

- Terminal value becomes a larger component of total returns

- Execution quality becomes a dominant variable

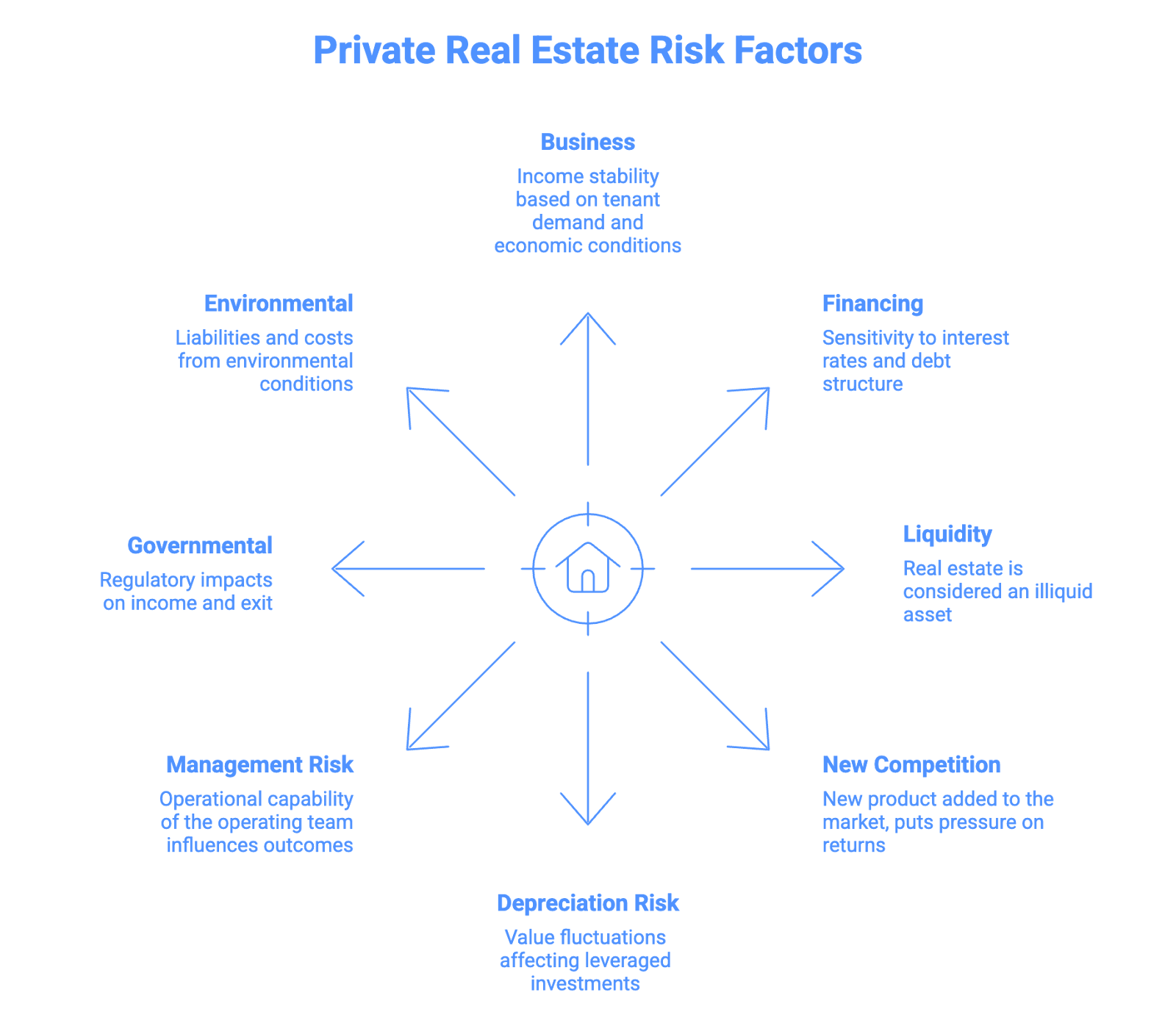

Private Real Estate Risk Factors That Shape Investment Outcomes

Risk classifications reflect how various risk factors interact within an investment. These private real estate risk factors determine volatility, downside exposure, and return potential.

Business Risk

Income stability depends on tenant demand, lease structure, and economic conditions. Properties with long-term leases and diversified tenant bases exhibit lower income volatility. Assets undergoing lease-up or repositioning experience greater variability.

Financing Risk

Leverage magnifies outcomes. Higher debt levels increase sensitivity to interest rates, refinancing conditions, and valuation changes. Debt structure also matters. Floating-rate debt introduces exposure to rate movements, while fixed-rate debt stabilizes cash flows.

Liquidity Risk

Liquidity depends on market depth and buyer demand. Stabilized assets in institutional markets transact more frequently. Specialized or transitional assets rely on narrower buyer pools.

Depreciation and Value Risk

Asset values fluctuate with market conditions. Declining values affect highly leveraged investments more severely, especially when debt balances remain constant.

Management and Execution Risk

Operational capability directly influences outcomes. Properties requiring leasing, renovation, or redevelopment depend heavily on sponsor expertise and oversight.

Governmental and Regulatory Risk

Taxes, zoning, rent regulation, and permitting affect both income and exit assumptions. Regulatory exposure varies by asset type and jurisdiction.

Environmental Risk

Environmental conditions introduce potential liabilities and remediation costs, particularly for older or industrial assets.

Each strategy emphasizes these risk factors differently.

Core Real Estate: Stability and Capital Preservation

Core real estate investments focus on income durability and capital preservation. These assets typically operate at or near full occupancy and generate predictable cash flows from existing operations. They can be multi-tenant properties but it’s also common for them to be single-tenant net properties, particularly in the industrial and retail sectors.

Asset Characteristics

Core assets often include institutional-quality office, multifamily, industrial, or retail properties located in established markets. Properties feature modern construction, strong physical condition, and limited deferred maintenance.

Income Profile

Cash flows derive from in-place leases with creditworthy tenants. Lease structures emphasize long-term commitments and limited rollover risk. Income supports regular distributions to investors.

Leverage and Capital Structure

Core investments use conservative leverage in the capital stack. Lower debt levels reduce refinancing risk and protect equity during market downturns.

Return Expectations

Returns emphasize income yield rather than appreciation. Total returns typically track modestly above inflation and reflect limited volatility.

Risk Profile

Core strategies face exposure to macroeconomic cycles and interest rates but benefit from operational simplicity and asset stability.

Role in Real Estate Syndications

In real estate syndications, core investments attract LPs seeking income, diversification, and capital preservation. These deals function as anchors within diversified portfolios.

Core-Plus Real Estate: Incremental Growth with Stability

Core-plus strategies retain the income focus of core assets while introducing moderate opportunities for growth. These investments require limited operational improvements to enhance value.

Asset Characteristics

Core-plus assets remain stabilized but exhibit identifiable inefficiencies. Examples include below-market rents, minor vacancy, or outdated amenities. They can stretch across all asset categories, including multifamily, retail, medical, and industrial.

Income and Upside

Properties generate current cash flow while offering modest NOI growth through rent optimization, expense management, or targeted upgrades.

Leverage and Capital Structure

Leverage remains moderate, similar to core assets. Debt supports enhancements without introducing excessive risk.

Return Expectations

Returns exceed core investments through incremental appreciation and higher cap rates while preserving income stability.

Risk Profile

Core-plus investments carry limited execution risk and moderate sensitivity to market conditions.

Role in Real Estate Syndications

Core-plus syndications appeal to LPs seeking a balance between income and growth. These strategies often complement core holdings by enhancing portfolio returns without materially increasing volatility.

Value-Add Real Estate: Active Management and Repositioning

Value-add investing business plans center on operational changes that generate returns. Returns depend on executing a defined business plan that improves an asset's NOI, thereby increasing its value.

Asset Characteristics

Value-add assets have existing operational challenges such as vacancy, deferred maintenance, or mismanagement. Properties often require capital improvements or leasing initiatives.

Cash Flow Dynamics

Income during early years may decline or stall while renovations and leasing activities progress. Cash flow increases as improvements take hold and the property stabilizes.

Leverage and Financing

Value-add strategies often employ higher leverage to amplify equity returns. Refinancing may occur once stabilized operations support improved valuations.

Return Expectations

Returns come from both income growth and valuation expansion. Exit value contributes meaningfully to total returns, often generating a large payout to GPs and LPs.

Risk Profile

Execution risk plays a central role to making a value-add project successful, and that relies heavily on GPs and their operating team. Market conditions, construction costs, leasing velocity, and management effectiveness also influence outcomes.

Position on the Real Estate Risk Return Spectrum

Value-add investments occupy the middle to upper portion of the spectrum, offering higher returns in exchange for operational complexity.

Role in Real Estate Syndications

Value-add syndications suit LPs comfortable with variability and longer hold periods. These investments reward disciplined underwriting and experienced sponsorship.

Opportunistic Real Estate: Complexity and Asymmetric Outcomes

Opportunistic strategies pursue returns through significant transformation or market dislocation. Examples are typically new development or re-development of a property. These investments involve the highest level of uncertainty but also generate the highest returns.

Asset Characteristics

Opportunistic deals include ground-up development, major redevelopment, distressed acquisitions, and investments in emerging markets or asset classes.

Capital Deployment

Capital requirements extend beyond acquisition costs. Development, entitlement, and repositioning require a lot of capital over extended periods.

Cash Flow Profile

Income generation often begins late in the hold period (often years after acquisition) or after completion. Early cash flow may remain minimal or negative until the property is near stabilization.

Leverage and Risk

Leverage frequently maximizes capital efficiency but increases exposure to market shifts and cost overruns. High risk can result in a high degree of capital loss if the project is unsuccessful.

Return Expectations

Returns target the upper end of the spectrum and rely heavily on terminal value realization.

Risk Profile

Market timing, execution quality, and capital availability drive outcomes. Variability remains high.

Role in Real Estate Syndications

Opportunistic syndications attract LPs seeking high growth potential and portfolio diversification. These investments require rigorous sponsor evaluation and tolerance for uncertainty.

Comparing Core, Core-Plus, Value-Add, and Opportunistic Strategies

Core, core-plus, value-add, and opportunistic strategies differ in how they generate income, grow in value, and respond to risk. These differences shape when returns show up, how predictable cash flow remains during the hold period, and how much the outcome depends on market conditions and sponsor execution.

Income Timing and Cash Flow Stability

Core and core-plus investments usually provide steady cash flow from the beginning because the properties are already leased and operating normally. Value-add and opportunistic investments often produce limited income early in the hold period because the focus remains on improving the property or completing a larger business plan before income increases.

Sources of Return and Value Growth

Core investments rely primarily on regular income with modest appreciation. As strategies move toward value-add and opportunistic investments, a larger portion of total returns comes from increasing the property’s value. Opportunistic investments depend heavily on selling the property at a higher value after major improvements, development, or repositioning.

Use of Debt and Financial Risk

Core investments typically use lower levels of borrowing, which reduces exposure to interest rate changes and market downturns. Value-add and opportunistic strategies often use more debt to enhance returns, which also increases the impact of market shifts or execution delays.

Exposure to Market Conditions

Core and core-plus investments tend to perform more consistently because stable tenants and long-term leases help protect income. Value-add and opportunistic investments respond more strongly to economic conditions because leasing demand, construction costs, financing availability, and exit pricing influence outcomes.

Execution and Sponsor Dependence

Core investments rely on disciplined property management with limited change to the asset. Value-add and opportunistic investments require active oversight of renovations, leasing, development timelines, and capital use. Sponsor experience becomes increasingly important as complexity grows.

How These Differences Shape Portfolio Construction

These differences explain how each strategy fits within a broader investment portfolio. Understanding how income timing, growth potential, debt usage, market exposure, and execution risk interact allows LPs to select strategies that align with their financial goals, risk tolerance, and investment timeline.

Evaluating These Strategies in Real Estate Syndications

LPs assessing real estate syndications should align strategy selection with their personal investment goals and risk tolerance.

Key considerations include:

- How long they want to be invested and liquidity needs

- Income versus capital growth preferences (ie - Do you want dividends or a large payout at exit?)

- Comfort with operational complexity and demands required of the GP to carry out the business plan

- Sponsor experience relative to strategy

- Portfolio diversification across the real estate risk return spectrum

LPs should identify how projected returns align with identified private real estate risk factors and whether underwriting assumptions reflect realistic execution.

Common Misinterpretations of Risk Classifications

Several misconceptions persist among investors:

- Asset class does not define risk category. Strategy and execution do.

- Higher projected IRRs do not eliminate risk exposure.

- Stabilized income today does not guarantee stability throughout the hold period.

- Sponsor capability influences outcomes as much as market conditions.

Using Risk Classifications as a Practical Framework

Core, core-plus, value-add, and opportunistic strategies provide a shared language for evaluating private real estate investments. These classifications help LPs interpret risk, align expectations, and compare opportunities across sponsors and markets.

Real estate syndications offer access to each segment of the real estate risk return spectrum. Informed investors assess how private real estate risk factors shape outcomes and select strategies that support long-term portfolio objectives.

Clarity around these distinctions transforms risk classifications from abstract labels into practical tools for disciplined investing.

Written by

Invest Clearly empowers you to make informed decisions by hosting unbiased reviews of passive investment sponsors from verified experienced investors.

Other Articles

Why Investor Voices Matter More Than Ever

Industry analysts have described a “data transparency crisis” in private markets, citing fragmented reporting, inconsistent data standards, and limited comparability across managers. This matters because limited visibility affects how investors assess sponsors, price risk, and respond when execution diverges from expectations.

Investor Experience Index: 2025 Wrap Up

We’ve analyzed review data from 2025 to uncover surprising trends in private real estate.

The New Approach to Sponsor Due Diligence in Private Real Estate

Start your due diligence with the sponsor and the business plan before focusing on the real estate asset.

Is Private Equity Coming to Your 401(k)?

A new executive order could lead to private markets getting access to 401(k) capital. Learn how a new wave of capital and liquidity demands could affect private real estate.

What 2025 Fundraising Data Reveals About LP Capital Allocation in Private Real Estate

Private real estate fundraising saw a rebound in 2025, marking the first year-over-year increase in annual capital raised since 2021. According the PERE Fundraising Report Full Year 2025, total fundraising reached $222 billion, up 29 percent from the $172.4 billion raised in 2024.

Limited Partners in Private Real Estate and Private Investments

If you’re exploring private real estate investing, you’ve likely encountered the term “limited partner” or “LP.” Understanding this role is essential before committing capital to any private market fund