Investor Experience Index Q2 2025: GP Takeaways

Never miss an Invest Clearly Insights article

Subscribe to our newsletter today

The Investor Experience Index provides a quarterly snapshot of how limited partners (LPs) rate their experiences with general partners (GPs). The data for this report is drawn exclusively from verified investor reviews published on Invest Clearly in Q2 2025.

When reviews are submitted to Invest Clearly, LPs provide an overall score but are also asked to rate sponsors across four specific data points:

- Pre-investment communication

- Post-investment communication

- Strength of leadership

- Alignment of expectations

These inputs create a more complete picture of investor sentiment. By analyzing correlations between category scores and overall ratings, the Investor Experience Index identifies the business practices that most directly impact satisfaction, trust, and repeat investment potential.

Below is our analysis and evaluation of trends observed in verified investor reviews in Q2, 2025.

Anonymous Reviews Score Lower Than Named Reviews

Transparency and motivation play a major role in review outcomes. In Q2 2025, nearly one-third of reviews were submitted anonymously, and these reviews averaged significantly lower scores (3.65) compared to reviews tied to a named investor (4.94). In fact, every 1-, 2-, and 3-star review came from an anonymous source.

.png)

Interpretation: 69.57% of 5-star reviews were named, showing that accountability correlates with positivity. This reflects how reviews are motivated. Negative reviews are often driven by strong emotional responses and tend to be submitted unprompted. By contrast, positive reviews are usually a result of GP outreach. These statistics are in alignment with consumer behavior across industries, according to a study by Zendesk.

Most satisfied investors don’t take the time to leave a public review unless asked. That’s why the bulk of five-star reviews on Invest Clearly come from named investors who were directly encouraged to share their experience.

Why this matters for GPs:

- If GPs rely only on organic reviews, the results may skew negative, because unprompted reviews are more likely to come from dissatisfied investors.

- To balance this natural bias, GPs must consistently request reviews from satisfied investors. Outreach not only generates more feedback, but also ensures that positive investor experiences are visible and represented in the aggregate data.

- The higher share of named reviews among 5-star ratings shows that investors are willing to stand behind positive experiences when prompted, which adds credibility and transparency.

Leadership Ratings Strongly Predict Overall Satisfaction

There is a very strong positive correlation (96%) between leadership ratings and overall ratings in Q2 2025 reviews. However, what’s most interesting is the relationship between leadership ratings and communication.

.png)

There is only a moderate positive relationship between leadership scores and pre-investment communication. However, the relationship between leadership and post-investment communication is extremely strong. Sponsors rated highly on leadership almost always received high marks on post-investment communication, and the reverse was true when leadership scored poorly.

Interpretation: Before the deal, investors may have given leadership the benefit of the doubt if communication feels clear and professional. After money is invested, leadership and communication become inseparable in the investor’s mind. Investors equate a strong leadership team with transparency, accountability, and responsiveness.

Post-investment communication is where leadership is proven. A GP cannot separate the two, investors equate leadership with how they are treated once their capital is committed.

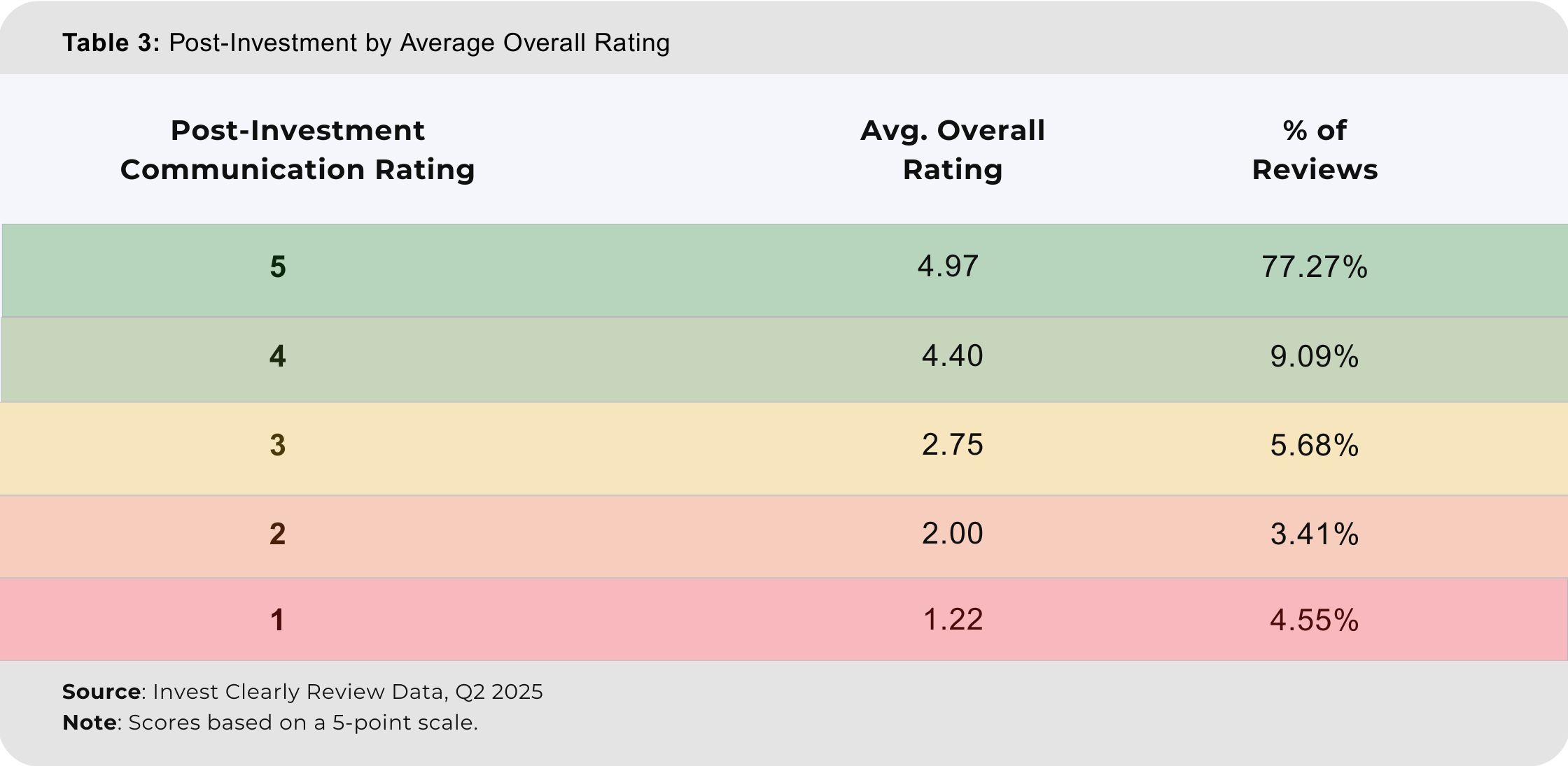

Post-Investment Communication Is the Critical Weak Point

When investors feel they are well-informed after investing (post-investment communication ≥ 4) they reward the sponsor with a good overall rating (4 or 5) 96% of the time. This suggests that strong, ongoing communication after the deal closes builds lasting confidence and goodwill. Even if other aspects of the investment aren’t perfect, consistent updates and transparency appear to maintain investor satisfaction.

Can GPs Recover from Poor Post-Investment Communication?

The data shows that communication after funds are committed is often where sponsors lose ground. Weak post-investment updates almost guarantee lower overall scores. Out of the Q2 2025 reviews with poor post-investment communication ratings (3 or less), only 16.67% still gave the sponsor a good overall rating (4 or more).

So yes, GPs can recover from poor post-investment communication, however, it is unlikely. When GPs receive good overall ratings when they have received a poor communication score, it can be inferred that the investment’s performance was strong and the LP is pleased with their returns.

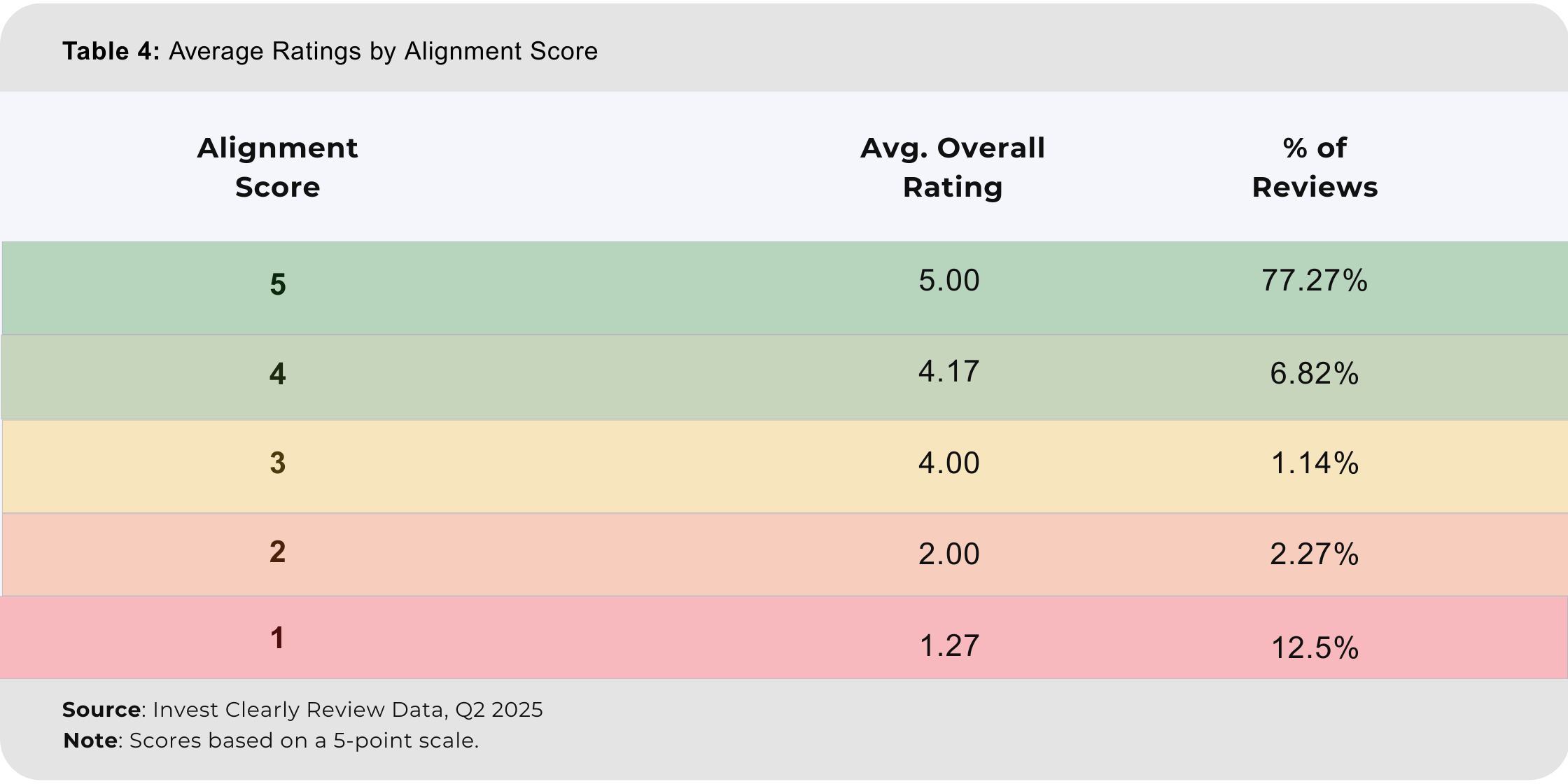

Alignment of Expectations

When investors feel their expectations were fully met or exceeded (alignment rating ≥ 4), they always reward the sponsor with a strong overall rating (4 or 5). This suggests that meeting expectations creates a baseline of trust and satisfaction that makes it almost impossible for the investor to rate poorly. Even if other factors weren’t perfect, aligned expectations seem to override smaller shortcomings.

Investors appear to measure success relative to what they thought would happen, not just absolute results.

- If reality meets or exceeds their mental benchmark, the review is positive.

- If it falls short, even slightly, it often triggers a disproportionately negative overall rating.

Can GPs Recover from Poor Alignment of Expectation?

Based on Q2 2025 data, within that 15.91% subset of reviews with an alignment score less than 3, only 7.14% gave a good overall rating.

This indicates that misaligned expectations create lasting dissatisfaction that can’t be fixed by other strong performance areas (like leadership or communication).

Investors may feel “misled” or “surprised” by the reality of the investment, which erodes trust and colors their overall perception.

Why This Matters for GPs

- Overpromising is dangerous. Even if financial results are strong, investors who feel expectations weren’t met will leave poor reviews.

- Clear communication upfront prevents disappointment later. Sponsors who explain risks, timelines, and potential challenges honestly are rewarded with stronger ratings.

- Expectation management is an ongoing task. Reinforcing key points throughout the investment period helps prevent “expectation drift” — when investors remember a rosier version of what was promised than what was actually communicated.

Conclusion

The Q2 2025 Investor Experience Index highlights the factors that most directly shape investor satisfaction. While financial performance will always matter, this quarter’s data shows that the investor experience is driven by how GPs communicate, lead, and manage expectations.

For GPs, the message is clear: reviews are not random commentary — they are a reflection of how investors experience your business. By focusing on consistent communication, visible leadership, and realistic expectation-setting, sponsors can directly improve their Investor Experience Index results. More importantly, these practices build long-term trust, repeat investment potential, and a durable competitive advantage in capital raising.

Written by

Invest Clearly empowers you to make informed decisions by hosting unbiased reviews of passive investment sponsors from verified experienced investors.

Other Articles

Investor Experience Index: 2025 Wrap Up

We’ve analyzed review data from 2025 to uncover surprising trends in private real estate.

The New Approach to Sponsor Due Diligence in Private Real Estate

Start your due diligence with the sponsor and the business plan before focusing on the real estate asset.

Is Private Equity Coming to Your 401(k)?

A new executive order could lead to private markets getting access to 401(k) capital. Learn how a new wave of capital and liquidity demands could affect private real estate.

What 2025 Fundraising Data Reveals About LP Capital Allocation in Private Real Estate

Private real estate fundraising saw a rebound in 2025, marking the first year-over-year increase in annual capital raised since 2021. According the PERE Fundraising Report Full Year 2025, total fundraising reached $222 billion, up 29 percent from the $172.4 billion raised in 2024.

Limited Partners in Private Real Estate and Private Investments

If you’re exploring private real estate investing, you’ve likely encountered the term “limited partner” or “LP.” Understanding this role is essential before committing capital to any private market fund

How Moving Up the Capital Stack Can Reduce Your Investment Risk

At the height of the worst financial crisis since the Great Depression, Buffett invested $5 billion in Goldman Sachs as preferred equity. Here's why....