Investor Experience Index Q3 2025: GP Takeaways

Never miss an Invest Clearly Insights article

Subscribe to our newsletter today

The Investor Experience Index provides a quarterly snapshot of how limited partners (LPs) rate their experiences with general partners (GPs). The data for this report is drawn exclusively from verified investor reviews published on Invest Clearly in Q3 2025.

When reviews are submitted to Invest Clearly, LPs provide an overall score but are also asked to rate sponsors across four specific data points:

- Pre-investment communication

- Post-investment communication

- Strength of leadership

- Alignment of expectations

These inputs create a more complete picture of investor sentiment. By analyzing correlations between category scores and overall ratings, the Investor Experience Index identifies the business practices that most directly impact satisfaction, trust, and repeat investment potential.

Below is our analysis and evaluation of trends observed in verified investor reviews in Q3, 2025.

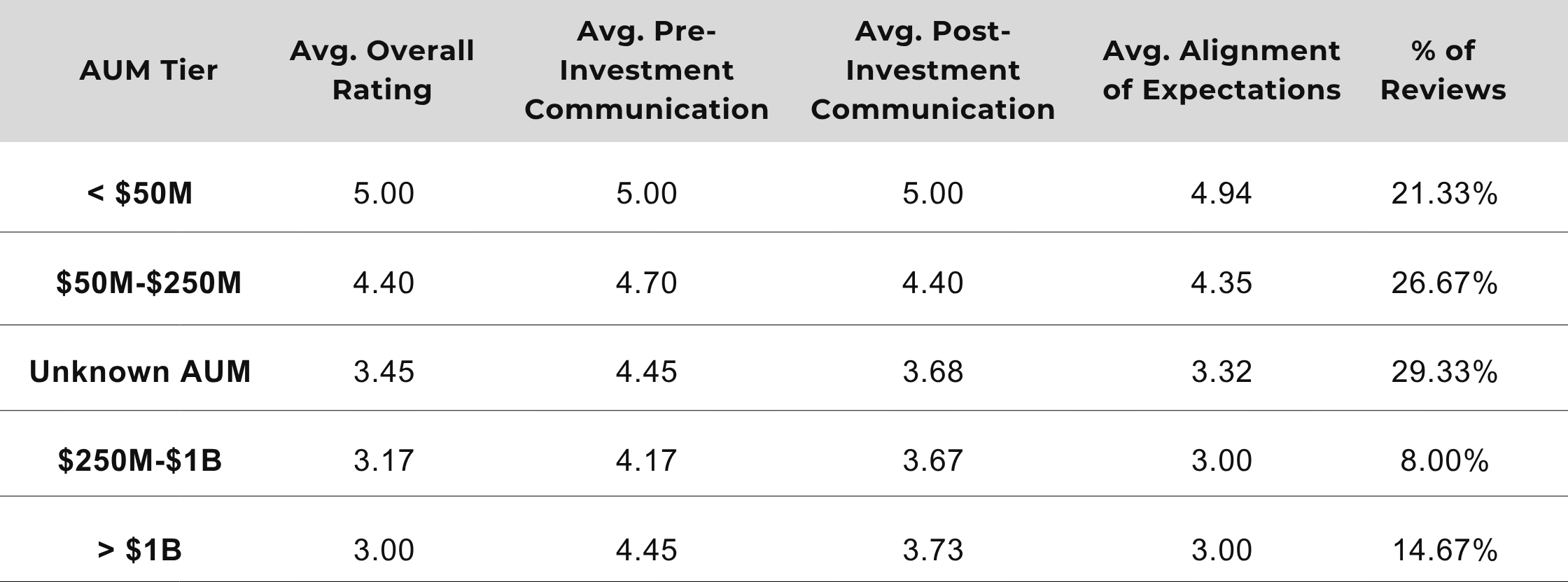

How Ratings Stack Up

When comparing category scores to overall ratings, clear patterns emerge in how investors evaluate their experiences. Five-star reviews show near-perfect scores across every category, while one-star reviews sharply decline across the board—most notably in post-investment communication and alignment of expectations.

.png)

First impressions are strong — but not enough

Pre-investment communication averaged 4.6+ across all reviews, even among investors who gave low overall ratings. This means that LPs are buying into GP marketing and communication during the capital-raising phase. However, the correlation (0.69) between pre-investment communication and overall satisfaction shows it’s necessary but not sufficient: investors’ lasting perception depends on what happens after they invest.

GP Action:

- Maintain your strong pre-investment touchpoints, but ensure the same level of communication consistency continues after closing.

- Treat onboarding and quarterly updates as critical trust checkpoints.

Post-investment communication drives dissatisfaction

Among 1-star reviews, post-investment communication averaged 1.7, compared to 4.9 for 5-star reviews. This sharp contrast reveals that when GPs go silent, investors lose confidence, even if the deal itself performs well.

GP Action:

- Develop a structured investor communications plan: consistent update cadence, transparency on performance, and proactive responses to challenges.

- Automate reporting workflows to ensure no LP feels “in the dark.”

Bigger Doesn’t Mean Better - Reviews by Sponsor AUM Tier

A sponsor’s AUM appears to impact investor satisfaction. In Q3 2025, sponsors managing less than $50M in assets received perfect scores across nearly every category, averaging 5.0 overall, compared to just 3.0 for sponsors exceeding $1B in AUM. The smallest sponsors also led in both communication and alignment of expectations, while mid-sized firms ($50M–$250M) maintained above-average consistency.

There are two reasons we could be seeing this trend:

- Review Bias from Investor Outreach: Smaller firms recognize the power of social proof and put more effort reaching out to satisfied investors to request reviews.

- Smaller Investor Pool: Smaller firms have fewer investors, they are able to provide better access to the GP, personalized communication, and spend more effort confirming alignment of expectations, ultimately providing a better investor experience.

- Complexity and Bureaucracy Dilute the Investor Experience: Larger organizations often rely on formalized processes and layered communication. While efficient, this can feel impersonal to investors accustomed to direct GP access.

As AUM increases, the relationship gap widens — communication remains strong, but alignment and overall satisfaction decline. This suggests that scale introduces challenges in maintaining the same level of transparency and responsiveness investors experience from more boutique operators.

Why This Matters for GPs

- Scale doesn’t automatically create trust. Larger firms with formal processes and institutional systems still risk losing investor confidence if their communication feels impersonal or transactional.

- Operational maturity must extend to investor engagement. As firms grow, they need to systematize reporting and relationship management.

- Smaller sponsors should capitalize on their advantage. Personalized investor experiences are a competitive edge. Reinforcing accessibility and responsiveness can help these firms retain loyalty as they scale.

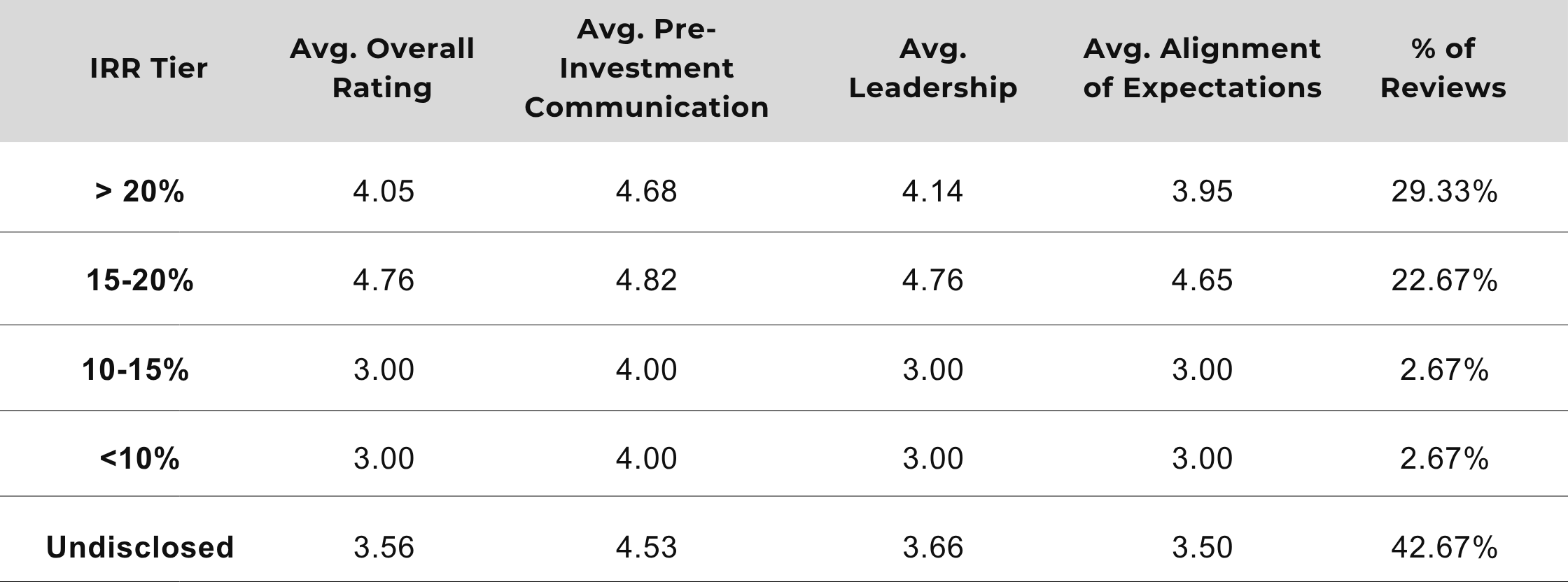

IRR Performance and Perception: Mid-Range IRR Sponsors Earn the Highest Ratings

Investor satisfaction peaks among sponsors reporting 15–20% average IRRs. These sponsors achieved the highest scores across every metric with averages near 4.7–4.8. In contrast, sponsors with IRRs above 20% scored lower overall (4.05), despite still maintaining strong communication ratings.

Possible reasons include:

- Selective or inflated reporting of performance figures.

- Promised returns exceeding actual outcomes, leading to expectation mismatches.

- Greater volatility or risk exposure inherent in high-IRR strategies.

- More sophisticated LPs holding sponsors to stricter standards.

- Scaling challenges that weaken consistency in investor relations.

The lowest-rated group was sponsors with undisclosed IRRs, representing 43% of Q3 reviews. Their average overall rating of 3.56 reinforces how transparency itself is a trust signal — absent it, satisfaction drops.

Why This Matters for GPs

- Realism builds credibility. Investors respond most positively to IRRs that feel attainable and consistent with market conditions.

- Transparency is a differentiator. Even moderate, clearly presented returns foster more trust than aggressive or unverified figures.

- High-return sponsors must emphasize verification. Backing claims with track record evidence and consistent reporting can close the perception gap.

Disclosure: IRR figures have not been verified by Invest Clearly

Conclusion

The Q3 2025 Investor Experience Index shows that credibility and consistency matter more to investors than scale or performance claims. Smaller firms may be outperforming larger ones in investor satisfaction due to stronger relationships and personalized communication, while larger sponsors face alignment and transparency challenges as they scale.

The IRR analysis reinforces this pattern: realistic expectations and transparency outperform ambition. Sponsors reporting 15–20% average IRRs earned the highest ratings across every category, suggesting that LPs value believable, consistent returns paired with trustworthy communication.

Ultimately, the investor experience is emerging as the new measure of performance. The GPs building the strongest reputations are not those with the largest portfolios or boldest projections, but those who communicate clearly, manage expectations, and build lasting confidence through transparency.

Written by

Invest Clearly empowers you to make informed decisions by hosting unbiased reviews of passive investment sponsors from verified experienced investors.

Other Articles

Investor Experience Index: 2025 Wrap Up

We’ve analyzed review data from 2025 to uncover surprising trends in private real estate.

The New Approach to Sponsor Due Diligence in Private Real Estate

Start your due diligence with the sponsor and the business plan before focusing on the real estate asset.

Is Private Equity Coming to Your 401(k)?

A new executive order could lead to private markets getting access to 401(k) capital. Learn how a new wave of capital and liquidity demands could affect private real estate.

What 2025 Fundraising Data Reveals About LP Capital Allocation in Private Real Estate

Private real estate fundraising saw a rebound in 2025, marking the first year-over-year increase in annual capital raised since 2021. According the PERE Fundraising Report Full Year 2025, total fundraising reached $222 billion, up 29 percent from the $172.4 billion raised in 2024.

Limited Partners in Private Real Estate and Private Investments

If you’re exploring private real estate investing, you’ve likely encountered the term “limited partner” or “LP.” Understanding this role is essential before committing capital to any private market fund

How Moving Up the Capital Stack Can Reduce Your Investment Risk

At the height of the worst financial crisis since the Great Depression, Buffett invested $5 billion in Goldman Sachs as preferred equity. Here's why....