Why Chasing ROI is Losing Investors Millions

By Paul Moore

Never miss an Invest Clearly Insights article

Subscribe to our newsletter today

Attention Investors: Are you chasing ROI?

STOP IT!

Your investment thesis might be all wrong. I should know… When I sold my staffing firm to a public company at 33, I thought, “I’m a full-time investor now!”

WRONG.

I was a full-time speculator. And sadly, I didn’t know the difference. (What good was that MBA, anyway?) I sought the highest possible returns on every investment. And I made another critical mistake…

I was a driven, Type A, suddenly bored entrepreneur. So I tried to achieve the same excitement from investing that I got from starting companies.

BAD IDEA.

Frankly, I didn’t know the difference between investing and speculating.

Investing is when your cash outlays are protected (by predictable cash flow), and you’ve got a chance to make a return.

Speculating is when your cash outlays are not protected at all, and you’ve got a chance to make a return.

There’s nothing wrong with speculating. As long as you’re being honest with yourself. But I propose you’ll have the best chance of amassing wealth by investing, not by speculating.

Sure, they make movies and write books the great entrepreneurs (aka speculators) who built companies like Microsoft, Google, and Amazon. But these are the exceptions… hence the fanfare.

Speaking of Amazon, Jeff Bezos once asked Warren Buffett: “You're one of the wealthiest guys in the world, and your investment thesis is so simple. Why doesn't anyone copy you?"

Buffett didn't blink: "Because no one wants to get rich slow."

Most wealth is amassed slowly and deliberately. And most who achieve great wealth understand…

The Truth About Risk and Return

Fill in these blanks:

Low risk leads to ___ returns. “Low” is the obvious answer.

High risk leads to ___ returns. “High” is the obvious answer.

But “High” is the wrong answer. High risk does not lead to high returns. It leads to the potential for high returns. And also, the potential for low returns. Or no returns. And a loss of principal.

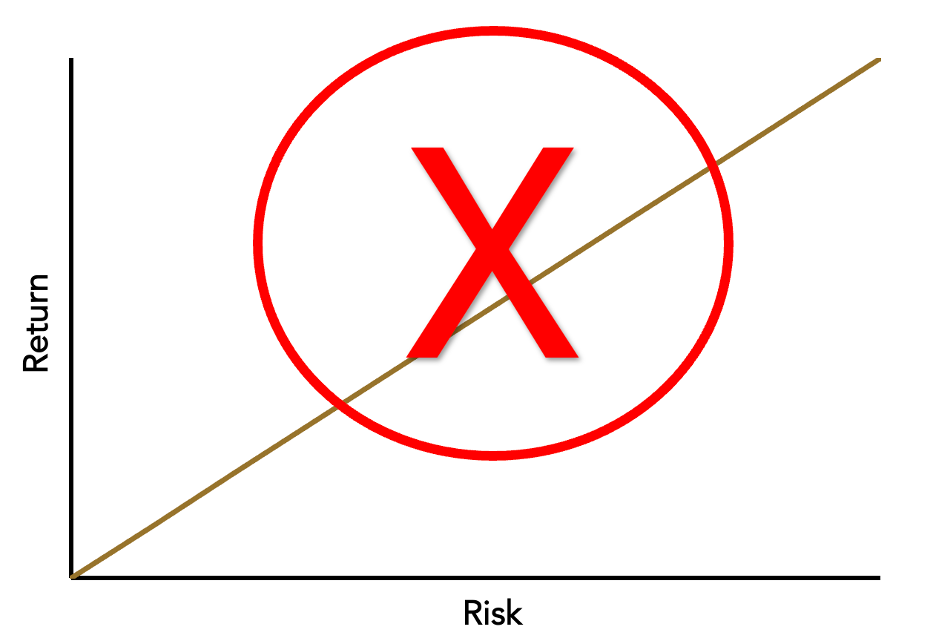

Most people look at Risk and Return like this:

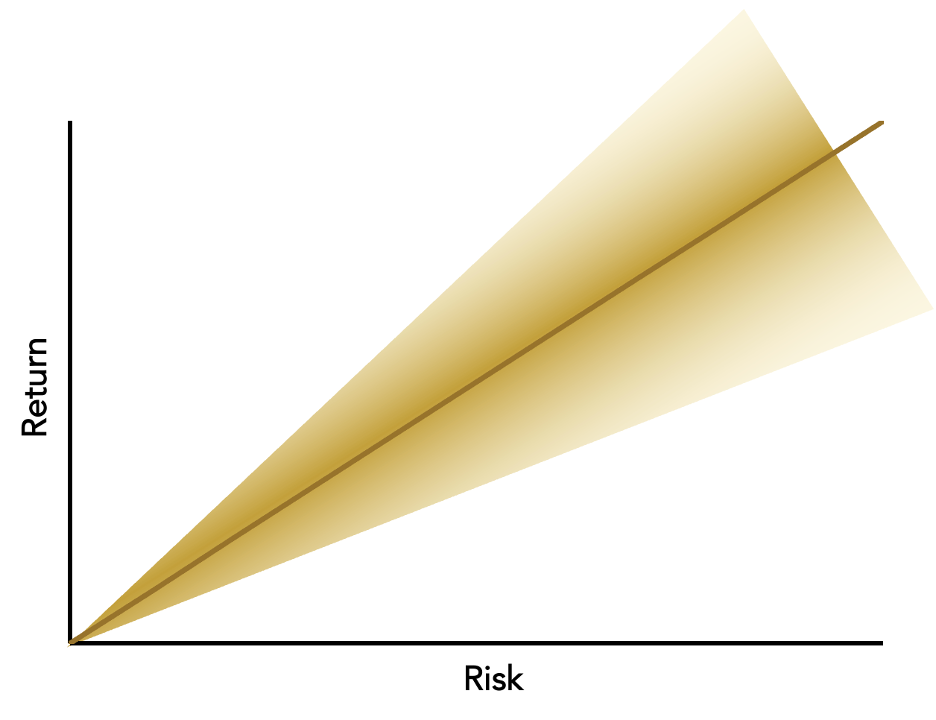

But this is a more accurate representation of Risk vs. Return:

The further out you go, the more unpredictable things become. Many CRE investors learned this the hard way these past few years.

But the solution isn’t to stop investing in private commercial real estate. The solution is to understand this principle, and to take concrete steps to manage risk and return.

You may think I’m talking about avoiding risky development deals or doubling down on due diligence. Yes, avoiding development may be appropriate for some (like me!). And due diligence is non-negotiable.

But there are more strategies you can implement to achieve asymmetric returns relative to your risk. We’ll discuss some of these in future posts (reach out to me if you can’t wait!).

Aiming for the Best Returns?

Let’s circle back to my question. Are you seeking investments with the best ROI? Here’s an example of why many investors are going about this wrong.

You hear about a multifamily deal projecting 15% annual return. You’re considering another deal projecting 20% annual return. Certainly, you’d want the latter, right?

Before deciding, it’s important to look at the components of the ROI. This allows you to evaluate (but not precisely calculate) the risk-adjusted return. (These examples are over-simplified.)

Deal #1: Projected ROI = 15%

An acquisition of an apartment complex with solid rents and stable occupancy. The operator is assuming low interest debt. This asset produces 8% average annual cash flow based on current income.

Assuming a mediocre or better economy with relatively stable cap rates, the operator plans to sell in five years. Conservatively assuming cap rate expansion (negative factor for returns) of 1%, the operator projects a 7% annual return from appreciation. The 8% cash flow plus 7% growth produces a projected annual return of 15%.

Deal #2: Projected ROI = 20%

A small apartment complex with strong occupancy and rents. This one has a twist: it includes ample land to double the number of units. The operator will partner with a builder who has experience on similar projects.

The acquisition cost is high relative to income due to the land value. Cash flow is projected at 2% for three years, then 9.5% for the next two (post-construction and lease-up). Projected annual appreciation is 15% over five years assuming 1% cap rate compression (positive factor for returns). Cash flow plus appreciation results in a 20% projected annual return (but the operator says it could exceed that!).

Which Deal Would You Choose?

There’s no universally correct answer. But most experienced investors I know would choose #1. Why?

Though there is no precise way to calculate a numerical risk factor, many would agree that the risk-adjusted return of #1 is higher than that of #2. Why?

Because Deal #2 depends on a development project going smoothly (permits, construction costs, lease-up, timing… plus a hundred unknowns).

Uncertainty = risk.

And more risk = a wider array of outcomes… and many outcomes aren’t the 20% projected by the sponsor.

Deal #2 has more things that can happen. That’s not always bad…but it absolutely affects the risk-adjusted return.

An Honest Confession

Earlier in my career, I absolutely would have chosen Deal #2.

Why?

Because it was exciting.

Because it might produce an even higher return.

Because entrepreneurs are addicted to upside potential.

Because I wanted material for my podcast How to Lose Money (238 episodes from 2016 to 2020). ☺

But years of investing professionally changed my thinking.

The most significant factor in this shift was the fact that my firm, Wellings Capital, manages other investors’ money. We have a sacred duty to carefully evaluate every knowable risk factor when selecting operators and investments. And to do everything in our power to prioritize the protection of our investors’ capital.

Written by

Paul Moore is the Founder of Wellings Capital. After graduating with an engineering degree and an MBA, Paul entered the management development track at Ford Motor Co. He later scaled and sold a staffing firm to a public co. in 1997. Paul began investing in real estate in 1999 to protect and grow his own wealth. He completed over 100 real estate investments, appeared on HGTV’s House Hunters, and developed a subdivision. After completing three commercial developments, Paul narrowed his focus to commercial real estate in 2011. Paul is married with four children and lives in Central Virginia. Press: Paul was 2x Finalist for Ernst & Young’s Michigan Entrepreneur and has contributed to BiggerPockets and Fox Business. He is the author of two real estate books: The Perfect Investment and Storing Up Profits. Paul co-hosted a wealth-building podcast called How to Lose Money and he’s been a featured guest on 300+ other podcasts including the BiggerPockets Podcast, The Real Estate Guys, and Entrepreneur on Fire.

Read Our ReviewsOther Articles

Why Investor Voices Matter More Than Ever

Industry analysts have described a “data transparency crisis” in private markets, citing fragmented reporting, inconsistent data standards, and limited comparability across managers. This matters because limited visibility affects how investors assess sponsors, price risk, and respond when execution diverges from expectations.

Investor Experience Index: 2025 Wrap Up

We’ve analyzed review data from 2025 to uncover surprising trends in private real estate.

The New Approach to Sponsor Due Diligence in Private Real Estate

Start your due diligence with the sponsor and the business plan before focusing on the real estate asset.

Is Private Equity Coming to Your 401(k)?

A new executive order could lead to private markets getting access to 401(k) capital. Learn how a new wave of capital and liquidity demands could affect private real estate.

What 2025 Fundraising Data Reveals About LP Capital Allocation in Private Real Estate

Private real estate fundraising saw a rebound in 2025, marking the first year-over-year increase in annual capital raised since 2021. According the PERE Fundraising Report Full Year 2025, total fundraising reached $222 billion, up 29 percent from the $172.4 billion raised in 2024.

Limited Partners in Private Real Estate and Private Investments

If you’re exploring private real estate investing, you’ve likely encountered the term “limited partner” or “LP.” Understanding this role is essential before committing capital to any private market fund